Published 22 June 2020

MISSA Investments bounce back, cash flow remains positive

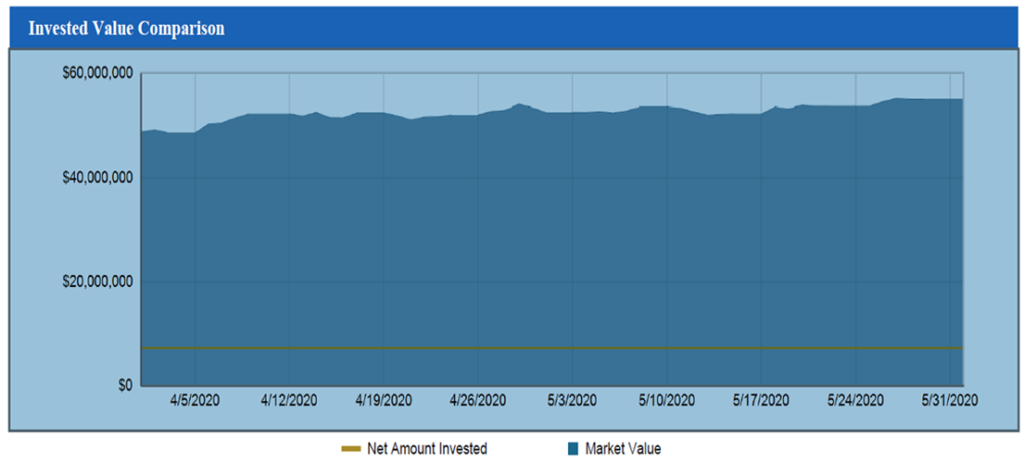

Before 2019 ended, the markets were trading at all-time highs that increased MISSA’s investments by $3.103 million during the quarter ending December 31, 2019. However, the emergence of COVID-19 in early January seriously impacted the market. The brunt of the corona virus grew larger with each passing day that by March 31, 2020, the gain was totally wiped out by a $10.563 million drop in its market value.

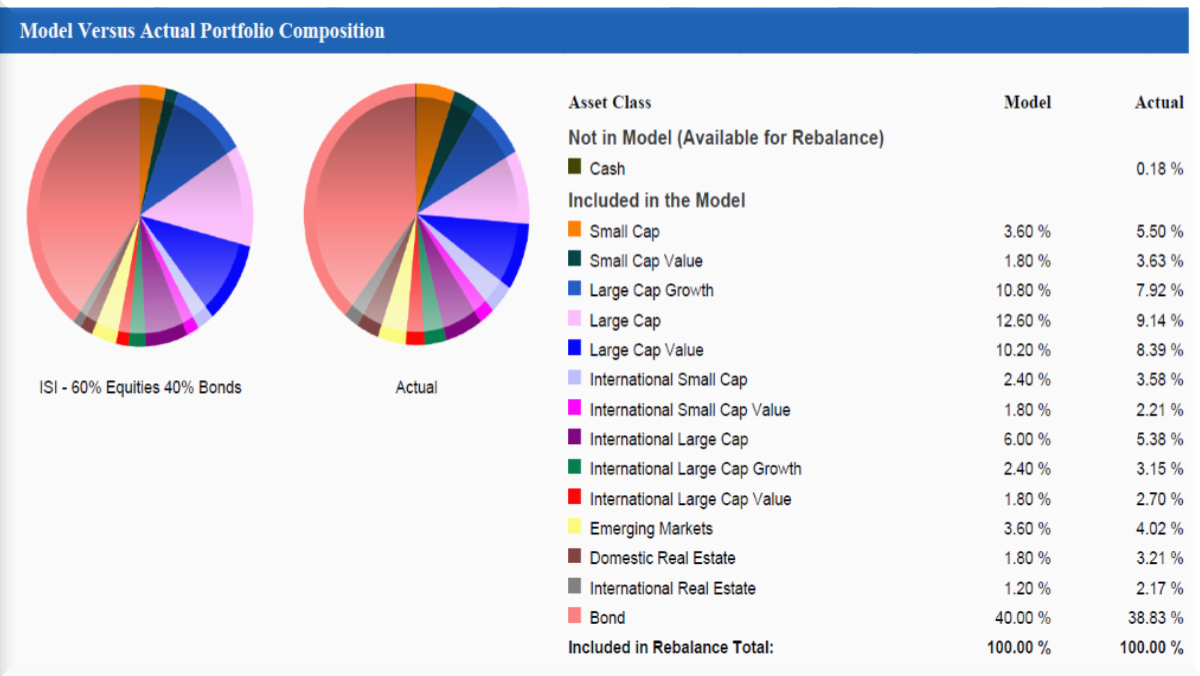

Expecting continual volatility in the world market, the MISSA Board, as advised by its investment advisor, kept calm and continued to stick with the current IPS of 60% equity and 40% fixed income portfolio. To improve and stabilize the asset allocation, the board deemed that it was wiser to buy equity with cheaper prices. Small cap exposures were reduced with corresponding increase in large cap values and MISSA repositioned on equities with very low rates. Fortunately, all fixed income assets yielded positive results, and with government stimulus package in place, the world market started to stabilize gradually. Subsequently, MISSA’s investments bounced back with increases in market value of $3.339 million in April and another $1.501 million in May. As of May 31, 2020, the market value of MISSA’s offshore investments stands at $55.083 million which is lower by just $2.620 million from its September 30, 2019 balance.

...

Recent Posts

- MISSA sues company for refusal to pay worker’s compensation and death benefits for worker involved in fatal accident

- Request for Proposals (RFP) For Investment Advisory Services

- MISSA’s Investment Committee to start more proactive oversight of the Retirement Fund

- 6 new MISSA Board members appointed by Cabinet

- Market value of MISSA’s foreign investments up by $10.5M in 2023