Retirement

Early Retirement Benefits

- The Claimant is service insured*;

- Have attained the age of 55; and

- Have filed an application

Normal Retirement Benefits

- The claimant is fully insured**;

- Have attained the age of 60;

- Have filed an application; and

- Have not applied for and received Early Retirement Benefits

- The Claimant is fully insured;

- Have attained the age of 60 and one month;

- Have filed an application; and

- Have not applied for and received Early Retirement Benefits or Normal Retirement Benefits.

* Service insured means a worker or a self-employed worker has earned at least eighty (80) quarters of coverage.

** Fully insured means a worker or self—employed worker has earned at least one quarter of coverage for each year beginning with the later of June 30, 1968, or the year in which the worker or self-employed worker attains the age of twenty-one (21) years and ending with the year before the year of death, attaining retirement age, or the year of becoming disabled, whichever first occurs; provided, however, that a worker or self-employed worker who dies, attains retirement age, or becomes disabled prior to October 1, 1983, must have no less than eight (8) quarters of coverage and a worker or self-employed worker who dies, attains retirement age, or becomes disabled after September 30, 1983, must have no less than twelve (12) quarters of coverage; provided, further, that the maximum number of quarters of coverage required shall be no more than thirty eight (38) quarters.

Commencement of Retirement Benefits

- A Claimant for Normal Retirement Benefits becomes entitled to such benefits beginning with the month that the conditions of eligibility were satisfied.

Amount of Retirement Benefits

- Retirement Benefits are computed on the Basic Benefit. The Basic Benefit is one-twelfth

(1/12) of the sum of the pension element and the social element, where the pension

element is two percent (2%) of indexed covered earnings and the social element is

fourteen and one-half percent (14.5%) of the first $11,000 of cumulative covered

earnings plus seven-tenths percent (0.7%) of cumulative covered earnings in excess of

$11,000 but not in excess of $44,000. - The monthly amount of the Normal Retirement Benefit is the Basic Benefit, but not less than $128.99; and

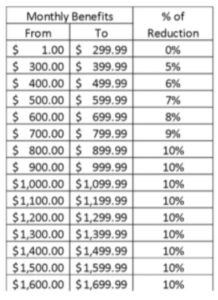

- Due to the passage of P.L. 2017-30 effective March 6, 2017, all monthly benefits greater than $299.99 were reduced as follows:

Reduction of Retirement Benefits Based Upon Subsequent Earnings

With respect to retired workers who continued to work until reaching the age of 65, the Retirement Benefit amount will be reduced by $1.00 for every $3.00 earned in a quarter in excess of $1,500. This is called the “EARNINGS TEST” (ET). The adjustment in benefits will be applied as soon as practicable following the quarter in which the earnings were made and reported. No adjustment is made for claimants who have attained the age of 65 years.

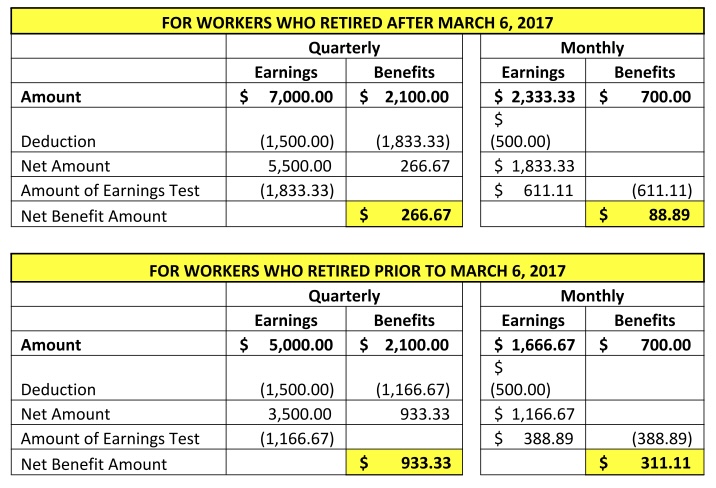

Illustration:

If a retired worker continues to work and earns a total of $7,000 in a quarter, while receiving Retirement Benefit of $700.00 per month, the benefit will be reduced during the three-month period, beginning with the first month after the quarter in which the earnings were made and reported.

The ET and Net Benefit are calculated as follows:

It is important to note that the calculation of Earnings Test prior to March 6, 2017 is based on the maximum gross tax able wages (GTW) per quarter of $5,000 and ET was applied until age 62. When the new MISSA law was passed on March 6, 2017, the maximum GTW per quarter was increased to $10,000 and ET is applied until age 65.

Suspension of Retirement Benefits

If a Claimant is not a citizen or national of the Marshall Islands, his Retirement Benefits will be suspended for any month after the sixth consecutive month during which the claimant is outside the Marshall Islands.

Note: Claimants whose application for retirement benefit was filed prior to October 1, 1990 (regardless of citizenship) are exempted from this provision and shall continuously receive the benefits even if they are already permanently residing off-island.

Paragraph 6.a. of this article does not apply to any Claimant who is a citizen or national of the Federated States of Micronesia, the Republic of Palau, or the United States of America, if the Federated States of Micronesia, the Republic of Palau, and the United States of America, respectively, extend periodic benefits on account of retirement to citizens and nationals of the Marshall Islands who are not citizens of the subject country, who qualify for such benefits, and who are permitted to receive such benefits outside the country without regard to the duration of the absence.

Evidence of Continued Entitlement

The Administrator may, at any time, require a claimant to provide evidence to the satisfaction of the Administration of his entitlement to the Retirement Benefit.

If the evidence required under Paragraph 7.a. of this Article is not produced within the time fixed by the Administrator, he may suspend payment of the benefit until such time the required evidence is produced.

Termination of Retirement Benefits

Retirement Benefits terminate the month before the month in which the Claimant dies.

Recomputation of Retirement Benefits Upon Subsequent

If a Claimant of Retirement Benefits earns covered wages after becoming eligible and receiving

Retirement Benefits, his benefits will:

- Be recomputed to reflect the increased earnings after each calendar year in which the earnings were made;and

- The adjusted benefit will be payable beginning with the first month following the year in which the earnings were made.

RETIREMENT PLANNER

Plan your retirement today.

The average life span now in the Marshall Islands may have shortened over the years, and for the elderly workers who have constantly been bothered by chronic illnesses, they may not be able to look forward to a blissful retirement that may last 25 years or even 35 years.

In some countries where retirement is considered the final career, people make the two of life’s most important decisions, WHEN TO RETIRE AND HOW TO SPEND THE FOLLOWING YEARS. These decisions requires just as much planning and foresight as the careers they are leaving behind.

Making your dream of having a secure and comfortable retirement is much easier when you consider different options available as you prepare for the future.

- Get information about MISSA’s retirement programs

- Get information about how your immediate family members may qualify for benefits

- Download application forms

- Inquire about your contributions and estimated benefits upon retirement (as this is not yet available online, you need to see personally our claims and benefits specialists and ask for a copy of your wage history and Individual ICE Calculation Worksheet)

- Get information about EARNINGS TEST, if you plan to continue working after you retire

- Get information about payment to non-citizens if, after retirement, you leave the Marshall Islands for more than six months

- Get information about proposed legislations that if passed into laws, may change the amount of your future benefits and the financial viability of the Marshall Islands Social Security System