Investments

Published 29 March 2009

RMI Social Security Investments

MISSA’s Investment Policy Statement (IPS) requires an allocation of 60% for equities and 40% for bonds/cash. The equity portfolio is prudent, widely diversified, and divided into 12 separate classes to reduce risk while achieving global market returns.

Except for MISC stocks and BOMI stocks and CDs (local investments), the Administration’s foreign funds are held and administered by Fidelity Investments IBG, MISSA’s Investment Custodian. Fidelity is independent from Investor Solutions, Inc., MISSA’s Investment Advisor, and is not affiliated or related to investment brokers.

Composition of MISSA foreign funds – In practice, MISSA only uses institutional grade no load index funds and exchnage traded funds (ETFs).

Decline in value and future outlook of MISSA’s foreign funds – MISSA’s funds have declined in value, but did not “go anywhere”. We believe that the world’s markets will recover and continue to grow in value over the life of the fund. The life of the fund is infinite and the current investment policy recognizes that markets are variable.”

Markets around the world have suffered in the current crisis. MISSA’s funds accurately reflect the performance of the markets in which they invest. During the last 18 months this has not been rewarding to investors, however over the life of the MISSA account we expect that exposure to the world’s stock markets will be quite profitable. MISSA has no cash flow needs for the foreseeable future, and has a huge allocation to fixed income of the highest quality with complete liquidity. As such, MISSA is well positioned to ride out the market downturn, and we believe that the current allocation is prudent, tailored to the needs of MISSA over the generations, and conforms to the agreed upon asset allocation.

...

Published 1 May 2007

MISSA's acquisition of BOMI and MISC shares

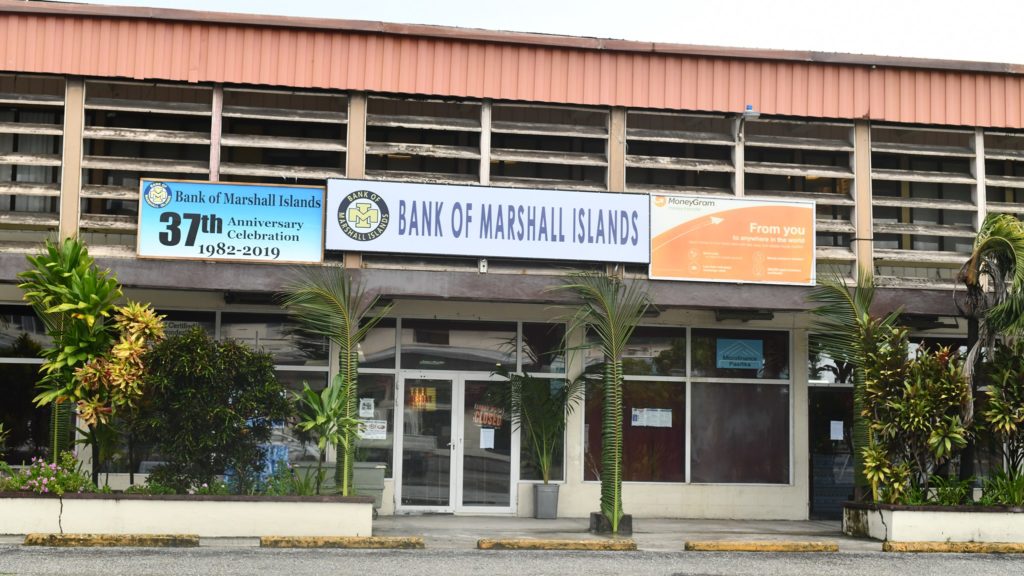

MISSA’s membership to the BOMI Board began in 2001 with three members and then four in 2003. MISSA’s 32% ownership of BOMI has allowed the Administration to have a controlling interest on the RMI’s strongest and most profitable financial institution.

During the annual stockholders’ meeting and election of Members of the Board of Directors held in 2007, the stockholders of the Bank of the Marshall Islands (BOMI) have once again re-elected MISSA Board Chairman Jack Niedenthal, Vice-Chairman Tommy Milne, Board Member Saeko Shoniber and Administrator Saane K. Aho. Mrs. Aho was also re-elected as Board Secretary, a post she held since 2003.

On February 19, 1999, the RMI Government fully repaid a loan and related interest, totaling $1.94 million, through transferring its ownership of 94,485 shares of the BOMI stocks to MISSA. Later, 30,000 of these shares were sold to a third party that subsequently reduced MISSA’s shareholding to 31%.

In August 2005, one of BOMI’s shareholders sold MISSA 200 of his BOMI shares as partial payment to his outstanding social security obligations.

Since MISSA’s acquisition of these shares, the Administration received annual dividends from BOMI amounting to about $1.2 million. As of September 30, 2007, the shares at BOMI are valued at $6.9 million.

MISSA also holds 3,000 shares of stock, at $10.00 par value, in the Marshall Islands Service Corporation (MISC).

Aside from MISSA’s stock ownership, the Administration also has $4.3 million of Time Certificate of Deposits at BOMI which earn 5.5% interest per year. Although some are of the opinion that these funds could be better invested locally, the MISSA Board believes otherwise.

MISSA’s funds that are deposited to BOMI are in turn loaned out to the community at an interest rate of about 18% per year. When BOMI makes a profit from the use of these funds, MISSA also benefits. If MISSA were to withdraw these funds from the bank, not only would the bank suffer, but also MISSA, and especially the residents of the Marshall Islands and the business community.

In addition, the MISSA Board and Administration anticipate that payments to beneficiaries and operating expenses will exceed revenues. The TCDs represent MISSA’s short-term reserves and will be utilized to ensure that MISSA has enough cash reserves available for uninterrupted payments to the retirees and other beneficiaries of the Retirement Fund. Therefore, the TCDs at BOMI are one of MISSA’s most important assets and will only be withdrawn to pay the retirees and beneficiaries.