General Provisions

General Provisions

SKIP TO:

Retirement Benefits

The Retirement Fund was established to provide a financially sound social security system with pension benefits and early retirement, whereby workers would obtain a measure of financial security in their old age and during disability, and whereby surviving spouses and children of deceased workers would receive some financial support after the death of the worker.

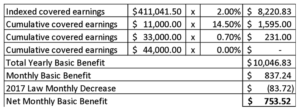

Retirement benefits are computed based on the Basic Benefit. The basic benefit is one-twelfth (1/12) of the sum of the pension element and the social element, where the pension element is two percent (2%) of indexed covered earnings* and the social element is fourteen and one-half percent (14.5%) of the first $11,000 of cumulative covered earnings plus seven tenths percent (0.7%) of cumulative covered earnings in excess of $11,000 but not in excess of $44,000.

“Indexed covered earnings” means the sum of all covered earnings for a worker or a self- employed worker increased by cost of living adjustments granted under Section 147 of this Chapter, subsequent to the date of said earnings.

Below is a sample calculation of basic benefit assuming that indexed covered earnings is $411,041.50:

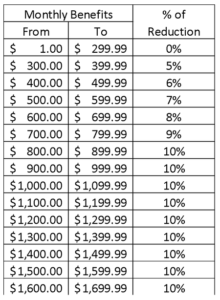

However, due to the enactment of P.L. 2017-30 effective March 6, 2017, all monthly benefits greater than $299.99 shall be reduced as follows:

Note 1: To lessen the immediate impact of the benefit cuts, the reductions were phased in over a period of 3 years wherein only 1/3 was implemented from Mar. 9, 2017 through Sep. 30, 2017; 2/3 from Oct. 1, 2017 until Sep. 30, 2018; and effective Oct. 1, 2019, 100% of the reduction was enforced.

Note 2: A maximum benefit of $1,200 per month was set for those who retired on March 6, 2017 and onward. Those who have retired prior to March 6, 2017 have a maximum benefit of $1,600 per month.

Early retirement benefits – Effective March 6, 2017, early retirement was stopped, and all those who received early retirement benefits prior to this date were grandfathered.

Normal retirement benefits – On November 12, 2021, the Nitijela of the Marshall Islands passed P.L.2021-36 (Bill 45). It capped the normal retirement age to 63.

Deferred retirement benefits – Effective March 6, 2017, deferred retirement was stopped, and all those who received deferred retirement benefits prior to this date were grandfathered.

Disability Insurance Benefits

To be entitled, the claimant must be fully insured and currently insured and must be or have been unable to engage in the continued performance of his duties by reason of any medically determinable physical or mental impairment.

“Fully insured” means a worker or self-employed worker has earned at least one quarter of coverage for each year beginning with the later of June 30, 1968, or the year in which the worker or the self-employed worker attains the age of twenty-one (21) years and ending with the year before the year of death, attaining retirement age, or the year of becoming disabled, whichever first occurs; provided, however, that a worker or self-employed worker who dies, attains retirement age, or becomes disabled prior to October 1, 1983, must have no less than eight (8) quarters of coverage and a worker or self-employed worker who dies, attains retirement age, or becomes disabled after September 30, 1983, must have no less than twelve (12) quarters of coverage; provided, further, that the maximum number of quarters of coverage required shall be no more than thirty-eight (38) quarters.

“Currently insured” means having earned at least six quarters of coverage during the most recent forty (40) quarters ending with the quarter of the worker’s retirement, disability or death, whichever first occurs. Currently, the minimum disability insurance benefit is $128.99.

Surviving Spouse Insurance Benefits

The surviving spouse of a worker who is fully insured and dies is entitled to a surviving spouse insurance benefit of 100% of the basic benefit, subject to the maximum and minimum survivor benefits, and subject to the earnings test. This is paid until remarriage or until death of the surviving spouse, whichever occurs first.

Surviving Child Insurance Benefits

Each surviving child of a worker who is fully or currently insured and dies is entitled to a surviving child’s insurance benefit of 25% of the basic benefit; provided, however, that the total monthly survivor’s insurance benefits payable to both Surviving Spouse and the Surviving Children shall neither exceed the basic benefit applicable to the deceased wage earner nor be less than $128.99; and where more than one person is entitled to survivor’s benefits, the payments shall be made to all such beneficiaries proportionately to the percentage of basic benefit due them.

Lump-sum Benefits

On November 2, 2018, P.L. 2018-98 was passed by the Nitijela, giving non-citizens the option to receive lump-sum benefits equivalent to 80% of the workers’ contributions but must meet the age requirements under normal retirement and provided that such workers will return for good to their own countries. Payment shall be made in two installments: 70% of the 80% shall be paid upon approval of the claim while the remaining 30% shall be withheld by MISSA for not less than 90 days.

A lump sum benefit is given if a worker or self-employed worker has reached the retirement age of 63, or is disabled or died while the worker or deceased worker has not yet reached the eligibility requirements for retirement or disability benefits.

Prior to November 2, 2018, if monthly survivor benefits are not paid or are stopped because all beneficiaries become disqualified as a result of death, remarriage, adoption, attainment of 18 (or age 22 if a bona fide student), or recovery from disability, a lump-sum benefit is due; provided that the benefits paid for under the wage earner’s account are less than 4% of his CCE. The amount of lump-sum benefit equals the total CCE multiplied by 4% less the total monthly benefits already received under the wage earner’s account.

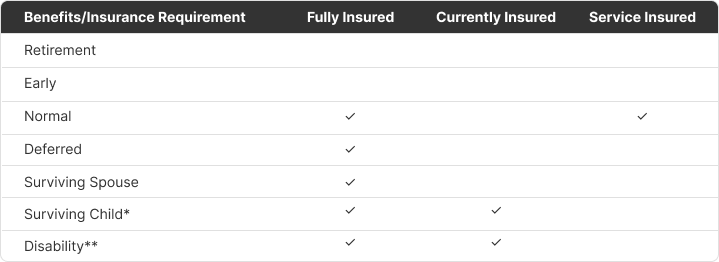

INSURANCE REQUIREMENTS

Requirements for Entitlement to Retirement,

Surviving Spouse/Child, and Disability Insurance Benefits