Frequently Asked Questions

General Information

Visit our Membership page for a complete list of requirements by clicking here.

The primary use of a social security number is for employment, and in certain cases, for school requirements. Unless the dependent is a student or finds legal employment in the Marshall Islands, and has submitted the above stated requirements, MISSA shall not issue a social security number.

No. The primary use of a social security number is for employment, and in certain cases, for

school requirements. Unless the dependent is a student or finds legal employment in the

Marshall Islands, and has submitted the above stated requirements, MISSA shall not issue a

social security number.

Yes. All banks and lending institutions in the RMI accept MISSA benefits as payment for retiree loans. Duly approved allotment forms must be submitted to MISSA before payments are made

to the creditors.

No. However, MISSA may allow a beneficiary to use his/her monthly benefit as payment for a bank loan provided a completed and duly approved allotment form is submitted to MISSA.

You may request Claims and Benefits personnel to print a Social Security Statement for you.

You may request our Claims and Benefits personnel to print the ICE calculation sheet for you.

You may visit our Front Desk or Tax Compliance Department and ask for a printout of your

Wage History. This form reflects all the quarterly payments received by MISSA that were

applied to your name, including your gross and taxable gross wages per quarter.

Benefits

As approved by the Nitijela of the Marshall Islands, the normal retirement age is now fixed at 63 years.

Effective March 2017, MISSA has stopped granting early and deferred retirement benefits.

Pursuant to the Social Security Act, for workers who retired after March 6, 2017 and are under

65 years of age and are still working, their benefit amount shall be reduced by $1.00 for every

$3.00 earned in a quarter in excess of $1,500. This is called the Earnings Test (ET) application.

The adjustment in benefits will be applied as soon as practicable following the quarter in which

the earnings were made and reported. No adjustment is made for claimants who have attained the age of 65 years.

For those who retired prior to March 6, 2017, ET application was stopped at age 62.

Pursuant to Section 142 of the Social Security Act (the Act) found at 49 MIRC 142 (1) – Unless

modified by a totalization or bilateral agreement, no more than six (6) months of benefit

payments under this Chapter shall be paid to any beneficiary who is not a citizen or national of

the republic while the beneficiary has been outside of the republic; provided, however,

payments shall be made to citizens and nationals of the Federated States of Micronesia (FSM),

the republic of Palau (ROP), and the Unites States of America (USA) as if they were citizens or

nationals of the republic, if FSM, ROP and USA, respectively, extend reciprocal benefits to

citizens of the Marshall Islands.

For workers who retired prior to March 6, 2017, the maximum monthly benefit is $1,600, while

those who retired on March 6, 2017 or after, the maximum monthly benefit is capped at

$1,200.

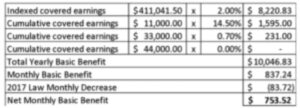

Retirement Benefits are computed on the Basic Benefit. The Basic Benefit is one-twelfth (1/12)

of the sum of the pension element and the social element, where the pension element is two

percent (2%) of indexed covered earnings and the social element is fourteen and one-half

percent (14.5%) of the first $11,000 of cumulative covered earnings plus seven-tenths percent

(0.7%) of cumulative covered earnings in excess of $11,000 but not in excess of $44,000.

Below is a sample calculation of basic benefit assuming that indexed covered earnings is $411,041.50:

No. Double dipping is not allowed. However, the surviving beneficiary will receive the benefit

with the higher amount.

- Death;

- If a medical retiree was able to recover from disability and finds gainful employment;

- If a surviving spouse has remarried (by legal or common-law marriage);

- If a surviving child who has reached the age of 18 has stopped going to school, or has

married or has found gainful employment; or if in school, has reached the age of 22.

No. Contributions are non-refundable, unless the wage earner has two or more employers in the Marshall Islands (on the same period) and his or her quarterly contributions exceeded the required amount. If the wage earner reaches the age of 60, he or she may apply for a lump sum payment computed at 4% of the total cumulative taxable wages.

Earned wages of an employee are computed based on actual payments by his or her employer. If, for example, out of the eighty quarters of contributions by the employee, fifty (50) quarters were not remitted to MISSA by the employer, then, only thirty (30) quarters of earned wages will be credited to the employee’s wage history. Thus, the employee can not retire, even if retirement age has already been attained.

Yes. The Marshall Islands has entered into a totalization agreement with Palau and FSM. This agreement enables any Marshallese, Palauan or FSM citizen who is not eligible for a monthly old-age retirement benefit under the social security administration of any of these countries but has worked and paid social security contributions to two or all of the three countries, to combine his or her credited service earned under two or all three systems and becomes eligible for benefits.

On November 2, 2018, P.L. 2018-98 was passed by the Nitijela, giving non-citizens the option to

receive lump-sum benefits equivalent to 80% of the workers’ contributions only but must meet

the age requirements under normal retirement and provided that such workers will return for

good to their own countries. Payment shall be made in two installments: 70% of the 80% shall be paid upon approval of the claim while the remaining 30% shall be withheld by MISSA for not

less than 90 days.

Contributions and Tax Compliance

Effective March 2017, employees contribute 8% of their gross taxable wages (capped at $10,000 per quarter while employers pay the same rate as their employees.

No. If MISSA receives this kind of payment, the amount will be considered as partial payment

and will not be applied to any worker until both employee and employer shares are received in

full.

- All wages earned by foreign nationals who are exempt from tax imposed by the Republic, pursuant to the Compact of Free Association with the United States of America) (e.g. US citizens working for US contractors with USAKA in Kwajalein) and any other diplomatic acts (e.g. foreign nationals working in their respective embassies in the Marshall Islands and United Nations personnel);

- Any wages or income earned from sources outside the Republic of the Marshall Islands;

- Payments made by the employer as a result of an accident or sickness of the worker (other than sick leave), such as reimbursement of medical or hospitalization expenses;

- Payments made to or on behalf of the worker or his beneficiary from a trust or annuity;

- Payments made in cash or in kind, for casual labor not exceeding one week in any month of a quarter, if the work is not performed in the course of the employer’s trade or business;

- Reasonable housing and travel allowances (e.g. per diem); and

- All wages in excess of the maximum taxable wages of $5,000.00 per calendar quarter

Yes. Business owners are considered as “self-employed” workers and shall be deemed to be both their own employers and workers and, accordingly, are required to pay to the Fund for themselves both the workers’ and employers’ contributions. For purposes of tax computations, the owners are deemed to have earned twice the amount of earnings paid to the highest paid worker reported by them within a quarter or the earnings they actually received, whichever is higher. If a business owner has no other worker, he or she shall be deemed to have earned within a quarter seventy-five percent (75%) of his or her gross revenue for the quarter.

YES. Having no social security number does not exempt anybody, including alien workers, from paying MISSA taxes. However, it is the obligation of both the worker and his or her employer to obtain a Social Security number from MISSA.

Tax Audits are being conducted to determine whether employers, both Marshallese and foreigners, are declaring completely and accurately in their quarterly tax returns the gross taxable wages of their employees. Under the statute of limitations, MISSA is authorized to audit up to the last six (6) years of business operations.

MISSA charges interest of 12% per annum from the time the contributions fall due until they are paid in full. Moreover, MISSA, at the discretion of the Administrator, is authorized to impose a penalty of up to 100% of the total contributions and interest due thereon. In the event that the unpaid contributions, interest and penalties due are referred to the Legal Counsel for prosecution in court, the delinquent employer shall additionally be liable for all reasonable attorney’s fees and cost of litigation.

Yes. MISSA is offering affordable payment plans to employers who cannot afford to pay in one single payment. The payment plan ranges from six to sixty months, depending on the total amount of tax deficiency and the number of quarters covered by the promissory note.