Published 4 February 2024

Market value of MISSA’s foreign investments up by $10.5M in 2023

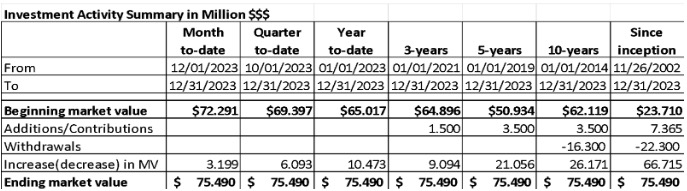

As 2023 ended, the Marshall Islands Retirement Fund remained financially healthy as its market value increased by $10.5 million which is equivalent to a time weighted annual net return of 16.11%, one of the highest investment gains of the Administration in the past 25 years. The quarter ended December 31, 2023 was also a very rewarding quarter as its market value has likewise grown by $6.09 million, which is equivalent to 8.78% time-weighted quarter net return.

As reported by Wealth Enhancement Advisory Services, MISSA’s Investment Advisor, the market value of the Administration’s foreign investments totaled $75.49 million as of December 31, 2023.

When the Administration engaged the services of Investor Solutions, Inc. (subsequently acquired by Wealth Enhancement Advisory Services two years ago) in November 2002, the market value of its foreign investments totaled $23.7 million only. Twenty-one years later, its market value has soared to $75.49 million (or more than 3-fold), despite the $22.3 million withdrawals between 2010 and 2016 due to cash flow crisis that was faced by MISSA as a result of the widening gap between contributions and benefits. MISSA has additional investments of $7.365 million during the same period.

Despite these high investment gains, the long-term financial viability of the Fund remains uncertain. The latest actuarial report showed that as of October 31, 2021, the Fund’s accrued liability amounted to $393.3 million while MISSA’s net assets totaled $104.2 million only. This resulted to an unfunded accrued liability of $289.1 million, which translates to a 26.49% funded status. In layman’s terms, a funded status of 26.49% means that if the Retirement Fund was dissolved on October 1, 2021 and all current beneficiaries and active contributors to the system were paid, MISSA can only afford to pay 26.49 cents ($0.2649) for every US dollar that are due to each of them.

During the 2023 APAFS sponsored Fiduciary Training and Investment Conference in Manila, 3 MISSA Board members and 2 senior officers attended the training to enhance their knowledge about their fiduciary responsibilities and learn best investment practices in the region.

To enhance its fiduciary capability, the MISSA Board has created an Investment Committee comprised of selected Board members and MISSA’s senior managers. The Committee’s role is one of strategic direction and oversight of MISSA’s investments, both locally and outside the country. In the area of investments, MISSA Board members and senior officers have to be committed to learning what they need to know as custodian of the Retirement Fund to make informed decisions. As such, they are required by the Administration to attend the annual Fiduciary Trainings and Investment Conference sponsored by the Asia Pacific Association of Fiduciary Studies (APAFS) in Manila. Further, the Investment Advisor is required to present to the Board and MISSA management the quarterly investment performance report to ensure compliance to the approved Investment Policy Statement and assess whether fees incurred by or on behalf of the portfolio are appropriate and reasonable.

Recent Posts

- MISSA sues company for refusal to pay worker’s compensation and death benefits for worker involved in fatal accident

- Request for Proposals (RFP) For Investment Advisory Services

- MISSA’s Investment Committee to start more proactive oversight of the Retirement Fund

- 6 new MISSA Board members appointed by Cabinet

- Market value of MISSA’s foreign investments up by $10.5M in 2023