Foundation

Overview

The Marshall Islands Social Security Administration (MISSA), a component unit of the Republic of Marshall Islands (RMI), was established pursuant to RMI Public Law 1990-75 (the Social Security Act of 1990 or “the Act”), as amended. The law repealed the Social Security Act of 1987 and established MISSA to administer the Marshall Islands Social Security Retirement Fund (The Fund).

The Fund was established to provide a financially sound social security system with pension benefits whereby workers would be ensured a measure of security in their old age and during disability, and whereby surviving spouses and surviving children of deceased workers would be ensured support after the loss of the family’s income.

Additionally, MISSA is responsible for processing, monitoring and distributing benefit claims under the Prior Service Benefits Program. Accordingly, MISSA established the Prior Service Trust Fund (PSTF) to account for activities under this program.

On March 6, 1991, the Nitijela passed Public Law 1991-118 (The Social Security Health Fund Act of 1991), as amended, which directed MISSA to administer the Marshall Islands Social Security Health Fund.On April 11, 2002, the Nitijela passed Public Law 2002-57 to repeal the Social Security Health Fund Act of 1991 and to transfer the administration of the Health Fund to RMI’s Ministry of Health (MOH). However, the formal turn over did not take effect until December 1, 2002, with MISSA’s Deputy Administrator for Health Fund and its entire Medical Referral Team being absorbed by MOH.

Contributions to the Fund are governed by the Social Security Act of 1990, the last amendment of which was covered by Bill 75 or PL No. 2017-30 effective March 9, 2017 which imposes a tax on the quarterly income of every wage earner equal to eight percent of wages received. The maximum quarterly taxable wages is $10,000. Every employer is required to contribute an amount equal to that contributed by employees.

Retirement benefits are paid to every person who is a fully insured individual as defined by the Social Security Act of 1990, as last amended by Bill 75, and has attained the following:

(i) age 60 prior to March 9, 2017 (ii) age 61 by March 9, 2017 (iii) age 62 by January 1, 2019 (iv) age 63 by January 1, 2021 (v) age 64 by January 1, 2023 (vi) age 65 by January 1, 2025

and has filed an application for old age insurance benefits. Benefits are also paid to surviving spouses of deceased workers, subject to eligibility requirements, as long as they do not remarry. Eligible children who are not married and are not working may also receive benefits until eighteen or up until age twenty-two, if in school. Eligible children who became disabled before age twenty-two will continue to receive benefits for the duration of the disability. Disability benefits are paid to qualified workers for the duration of the disability or until retirement or death, at which time retirement or survivor benefits become available.

- Pension element – 2% of index covered earnings, plus;

- Social element – 14.5% of the first $11,000 of cumulative covered earnings in excess of $11,000 but not in excess of $44,000. The $11,000 and $44,000 bend points may be increased from time to time by wage index adjustments granted by the Board of MISSA.

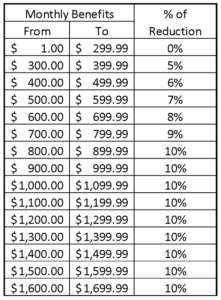

To lessen the impact of the benefit cuts, the reductions have been phased in over a period of three years wherein 2/3 will be subsidized by the Government in FY 2017 and 1/3 in FY 2018. The entire 100% cut shall be fully enforced in FY 2019.

...

Changes under Bill 75

- There will be no more early and deferred retirement starting March 9, 2017.

- Provisions on customary adopted child will be more stringent to ensure the long term sustainability of the Fund.

- “Earnings” was redefined to specify non-taxable earnings that include the following:

(i) payments made by the employer as a result of an accident or sickness of the worker (other than sick leave);

(ii) reimbursement of medical or hospitalization expenses;

(iii) payments made to or on behalf of the worker or his beneficiary from a trust or annuity;

(iv) reasonable stipends paid to volunteers of religious organizations, NGOs; and schools;

(v) reasonable sitting fees for board members and elected officials;

(vi) earnings exempted by virtue of any international agreement to which the Republic of the Marshall Islands is a party;

(vii) reasonable per diem and travel allowances to the extent that they do not exceed any comparable Government rates;

(viii) rental housing allowance paid to an employee, not exceeding Two Thousand Two Hundred and Fifty ($2,250) per quarter provided it does not exceed three times the wages;

(ix) any payment in the form of scholarship, fellowship or stipend made to any employee while he is a full-time, bona fide student at an educational institution;

(x) earnings received by a minister of the gospel, or clergyman from a religious group or organization;

(xi) earnings received by an employee for services performed or rendered in the capacity if a domestic or household employee for a private individual or family;

(xii) reasonable session allowances for elected officials; and

(xiii) payments made in cash, or any form other than cash, for casual labor not exceeding one week in any month of a quarter if the work is not performed in the course of the employer’s trade or business. For purposes of this Chapter, earnings shall be computed to the nearest cent;

(xiv) any payment to account of sickness or accident disability, or any payment of medical or hospitalization expenses, made by the employer, provided however, that normal wages or salaries paid to an employee for a period of time during which he is excused from work because of sickness shall not be excluded from wages and salaries under this paragraph; and

(xv) any payment made to or in behalf of an employee or to his beneficiary from a trust or annuity including distributions from qualified pension or deferred compensation plan trusts and annuities that are funded in whole or part by taxable wages.

...

Basis of Accounting:

MISSA is accounted for as a Fiduciary Fund Type – Private Purpose Trust Fund and prepares its financial statements using the accrual basis of accounting. It recognizes employee and employer contributions as revenues in the quarter employee earnings are paid. Retirement benefits are recognized as expenses when payable. Expenses are recorded when the corresponding liabilities are incurred regardless of when payment is made.

...

Financial Challenges

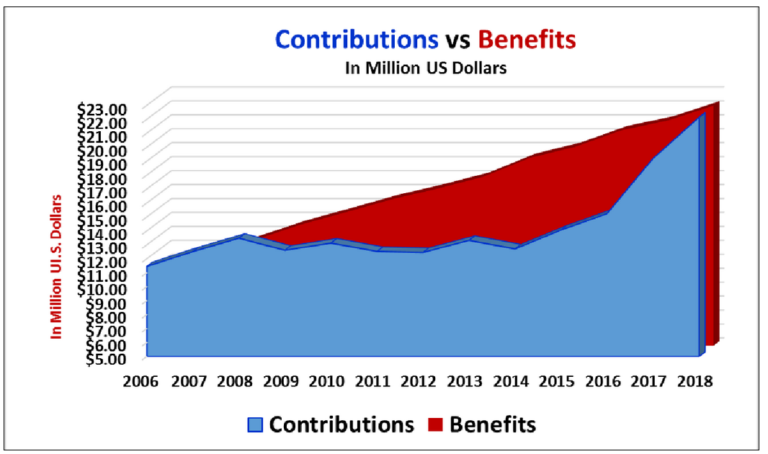

By 2008, the robust financial health of the Fund started to deteriorate as collections remain flat due to the country’s stagnant economy and high unemployment rate while benefits increased steadily at 5%-6% per year. In 2009, contributions could no longer sustain benefit payments forcing MISSA to use its cash reserves (TCDs) at a local bank to meet benefit payments on time. When the TCDs were used up in 2010, the Administration was forced to make a series of drawdowns from its foreign investments.

By the end of FY 2012 investment withdrawals totaled $5 million while net assets have dropped to $72.9 million.

On March 18, 2013, Bill No. 43 was introduced in the Nitijela to provide for changes that will lead to further financial stability of the Fund by removing loopholes, increasing contributions from 7% to 9%, and decreasing benefits by approximately 22%. Failure to enact these amendments will cause depletion of the Fund within nine years as current contributions cannot cover benefits.

Unfortunately, after a number of public hearings and consultation with the public and Nitijela, the reforms under Bill No. 43 were unsuccessful and that bill has since been eliminated.

With no other source of funds, the Administration had no other option but to continue drawing down from its offshore investments in order to meet its benefit payments on time. As of September 30, 2014, MISSA’s net assets dropped further to $72.3 million while total drawdowns reached $10 million.

In late 2014, MISSA started a series of consultative discussions with Wilshire Associates, a U.S. based consulting firm specializing in pension funds and investments. After months of actuarial and investment reviews, Wilshire presented several option plans which included a Plan Conversion Design from the current Defined Benefit (DB) System to a Defined Contribution (DC) Plan, setting up a maximum benefit for those who have received multiple times what they have contributed to the system, and increasing taxes while reducing benefits.

The Administration had also consulted over the years with a pension specialist from the International Monetary Fund. One of the suggestions presented to MISSA was to adopt a new benefit formula for new retirees to be phased in over a period of 5 years with RMI Government appropriations for MISSA.

...

The Turning Point

In April 2016, the Pacific Financial Technical Assistance Center (PFTAC), in cooperation with the International Monetary Fund and the Bank of the Marshall Islands, sponsored a three-day social security pension workshop in Majuro. This was attended by representatives from the social security systems of the RMI, Palau and FSM, including Palau’s Civil Service Pension Fund. MISSA’s consultants from Wilshire and Investor Solutions were also present.

It was evident during the presentations that the three countries have similar financial challenges in its social security and pensions funds but the Governments of Palau and FSM were able to mitigate the impact of these challenges on a timely manner through effective legislations and financial assistance. This may have influenced the mindset of RMI legislators and triggered a series of government initiatives which resulted to the creation of the National Task Force on Social Security by the Cabinet.

The Task Force, composed of eleven representatives from the Cabinet, Nitijela and private sector together with MISSA Management and consultants, paved the way to the conceptualization of the MISSA Reforms Bill, also known as Bill No. 47 (PL 2016-26). The bill was passed on September 29, 2016 by the Nitjela, with the implementation date set for January 1, 2017.

Consequently, the Nitijela’s Committee on Appropriations approved a $2.3 million government subsidy for MISSA for FY 2017. This provided the Administration with the much needed fiscal stimulus to remain operational, with only $1 million being withdrawn from its investments by the end of FY 2016.

However, the new MISSA reforms continued to receive protests and criticisms from the public.

...

Financial effects of the MISSA Reform Law

On December 13, 2016, MISSA received $575,000 from the Ministry of Finance representing 25% of the $2.3 million subsidy appropriated by the RMI Government.

On January 4, 2017, Bill 54 was introduced and subsequently passed by the Nitijela which deferred the effective date of PL 2016-26 to March 6, 2017. The members of the MISSA Task Force met again a number of times and came up with the final MISSA reforms bill which ultimately became Bill 75.

On February 28, 2017, Bill 75 was enacted into law (PL 2017-30) but was only certified by the Speaker before the Clerk of the Nitijela on March 9, 2017. As per Nitijla’s rules and regulations, the effective date of a new law is the date of the Speaker’s certification.

In preparation for the final implementation of the new law, MISSA’s Tax Managers and Legal Counsel met with accountants and employers to clarify what retirement fund tax rate to be used for the quarter ending March 31, 2017. Should it be the new tax rate of 8% or the old rate of 7%?

As the MISSA system can only recognize one tax rate for the retirement fund in a quarter, MISSA management decided to effect a pro-rata calculation. Consequently, MISSA deemed it reasonable and fair to use 7.29% for the first quarter of 2017. For the 2nd quarter, there will be no more confusion as the new tax rate of 8% will be used.

On March 24, 2017, MISSA received $1,725,000 from the Ministry of Finance representing the remaining balance of the $2.3 million RMI subsidy for the Administration.

As the effective date of the new MISSA reforms was pushed back to mid-FY 2017, only half of the financial effects of the tax increases and benefit reductions will be realized in FY 2017. As a result, the Administration requested a supplemental budget from the RMI Government. Consequently, a Memorandum of Agreement was signed by the MISSA Board Chairperson and the Minister of Finance which will enable MISSA to receive another $1 funding in FY 2017. This was subsequently received by MISSA on July 20, 2017.

To speed up the momentum of MISSA’s recovery, the Nitijela’s Appropriations Committee approved another $3.0 million subsidy for the Administration for FY 2018. This was father enhanced by the contributions having increased to $20.4 million in FY 2018.

By the end of FY 2018 MISSA’s cash flow stabilized and the Administration was even able to generate a cash surplus of $4.0 million whereby $2.0 was deposited to a local bank in the form of TCD earning 4% while the remaining $2.0 million was added to MISSA’s offshore investment.

Due to the consistent collection efforts of MISSA’s Tax Officers and Auditors coupled with legal referrals, contributions increased to almost $21 million in FY 2019 or $5.7 million (37.5%) higher than the revenue in 2016. This was the first time since 2008 when contributions exceeded benefit payments. It is also important to note that with the reductions in benefits and more stringent eligibility screening being put in place, the Administration was able to narrow down the gap between contributions and benefits. Prior to the new law, MISSA used to receive and process an average of 45 benefit claims every month. This has now dropped to only about 20-25 claims per month.

Having received $2.3 million appropriation from the RMI Government in FY 2019, the Administrations’ fiduciary net position soared to a record high $83.15 million as of September 30, 2019. This was $17.5 million or 26.7% higher than in FY 2016 when the MISSA reform law was not yet enacted.

Before 2019 ended, the markets were trading at all-time highs that increased MISSA’s investments by $3.103 million during the quarter ending December 31, 2019. However, the emergence of COVID-19 in early January seriously impacted the market. The brunt of the corona virus grew larger with each passing day that by March 31, 2020, the gain was totally wiped out by a $10.563 million drop in its market value.

Expecting continual volatility in the world market, the MISSA Board, as advised by its investment advisor, kept calm and continued to stick with the current IPS of 60% equity and 40% fixed income portfolio. To improve and stabilize the asset allocation, the board deemed that it was wiser to buy equity with cheaper prices. Small cap exposures were reduced with corresponding increase in large cap values and MISSA repositioned on equities with very low rates. Fortunately, all fixed income assets yielded positive results, and with government stimulus package in place, the world market started to stabilize gradually. Subsequently, MISSA’s investments bounced back with increases in market value of $3.339 million in April and another $1.501 million in May. As of May 31, 2020, the market value of MISSA’s offshore investments stands at $55.083 million which is lower by just $2.620 million from its September 30, 2019 balance.

Since the pandemic has not yet reached the country, business in the RMI “remains as usual”. MISSA was still able to meet its projected collections for the quarter ending September 30, 2020. But with international travel restrictions expected to drag for several months, a few private businesses, more particularly the hotel, tourism and airline sectors, are now faced with operational uncertainties. Albeit this particular segment of taxpayers may miss paying MISSA taxes in the next couple of quarters, their contribution is just a very small fraction of the total revenues that MISSA collects and will not have a significant impact on MISSA’s cash flow.

In the event that the pandemic reaches the RMI and a business lockdown becomes imminent, MISSA remains confident that its cash flow will remain positive beyond 2020 without making any investment drawdowns. So long as MISSA receives on time the Government’s weekly remittances and quarterly subsidies, coupled with the $2.0 million TCD at a local bank that may be withdrawn any time, MISSA will still be able to pay without interruptions, its more than 4,600 beneficiaries every month until business returns to normal.