About Us

ABOUT US

Reforming the System to Sustainability

The Marshall Islands Social Security Administration (MISSA) is a component unit of the Republic of the Marshall Islands (RMI) that aims to provide its people pension benefits, security benefits, and support for the elderly, the disabled, living immediate family members of deceased workers.

OUR VALUES

Striving for the Betterment

of Our Organization

Integrity

Maintaining the public's trust by good example and adhering to consistent standards of conduct in our actions and decisions

Making a Difference

Creating a mindset of doing ordinary things extraordinarily well

Sustainability

Meeting the needs of the present without compromising the ability of future generations to meet their own needs.

Accountability

Taking ownership to our actions by embracing a prudent spending and fund management philosophy

Stewardship

Acting with an owner mentality and continuously protecting the public stake in our resources

Foundation

The Marshall Islands Social Security Administration (MISSA), a component unit of the Republic of Marshall Islands (RMI), was established pursuant to RMI Public Law 1990-75 (the Social Security Act of 1990 or “the Act”), as amended. The law repealed the Social Security Act of 1987 and established MISSA to administer the Marshall Islands Social Security Retirement Fund (The Fund).

The Fund was established to provide a financially sound social security system with pension benefits whereby workers would be ensured a measure of security in their old age and during disability, and whereby surviving spouses and surviving children of deceased workers would be ensured support after the loss of the family’s income.

Additionally, MISSA is responsible for processing, monitoring and distributing benefit claims under the Prior Service Benefits Program. Accordingly, MISSA established the Prior Service Trust Fund (PSTF) to account for activities under this program.

On March 6, 1991, the Nitijela passed Public Law 1991-118 (The Social Security Health Fund Act of 1991), as amended, which directed MISSA to administer the Marshall Islands Social Security Health Fund.

On April 11, 2002, the Nitijela passed Public Law 2002-57 to repeal the Social Security Health Fund Act of 1991 and to transfer the administration of the Health Fund to RMI’s Ministry of Health (MOH). However, the formal turn over did not take effect until December 1, 2002, with MISSA’s Deputy Administrator for Health Fund and its entire Medical Referral Team being absorbed by MOH.

Contributions to the Fund are governed by the Social Security Act of 1990, the last amendment of which was covered by Bill 75 or PL No. 2017-30 effective March 9, 2017 which imposes a tax on the quarterly income of every wage earner equal to eight percent of wages received. The maximum quarterly taxable wages is $10,000. Every employer is required to contribute an amount equal to that contributed by employees.

Mission

To establish for the people of the Republic of the Marshall Islands a financially sound social security system with pension benefits and early retirement, whereby workers would be ensured a measure of security in their old age and during disability, and whereby surviving spouses and surviving childrend of deceased workers would be ensured support after the loss of the family’s income, and for matters connected herewith and incidental thereto.

Vision

MISSA also aims to safequard and sustain the financial stability of the retirement fund by operating within the guidelines of the law, compliance to set polices and procedures, and adherence to the principles of good overnance,transparency and accountability

BOARD OF DIRECTORS

Board Chairman

Board Members

MANAGEMENT & STAFF

Executive Team

Management & Staff

Our Consultants

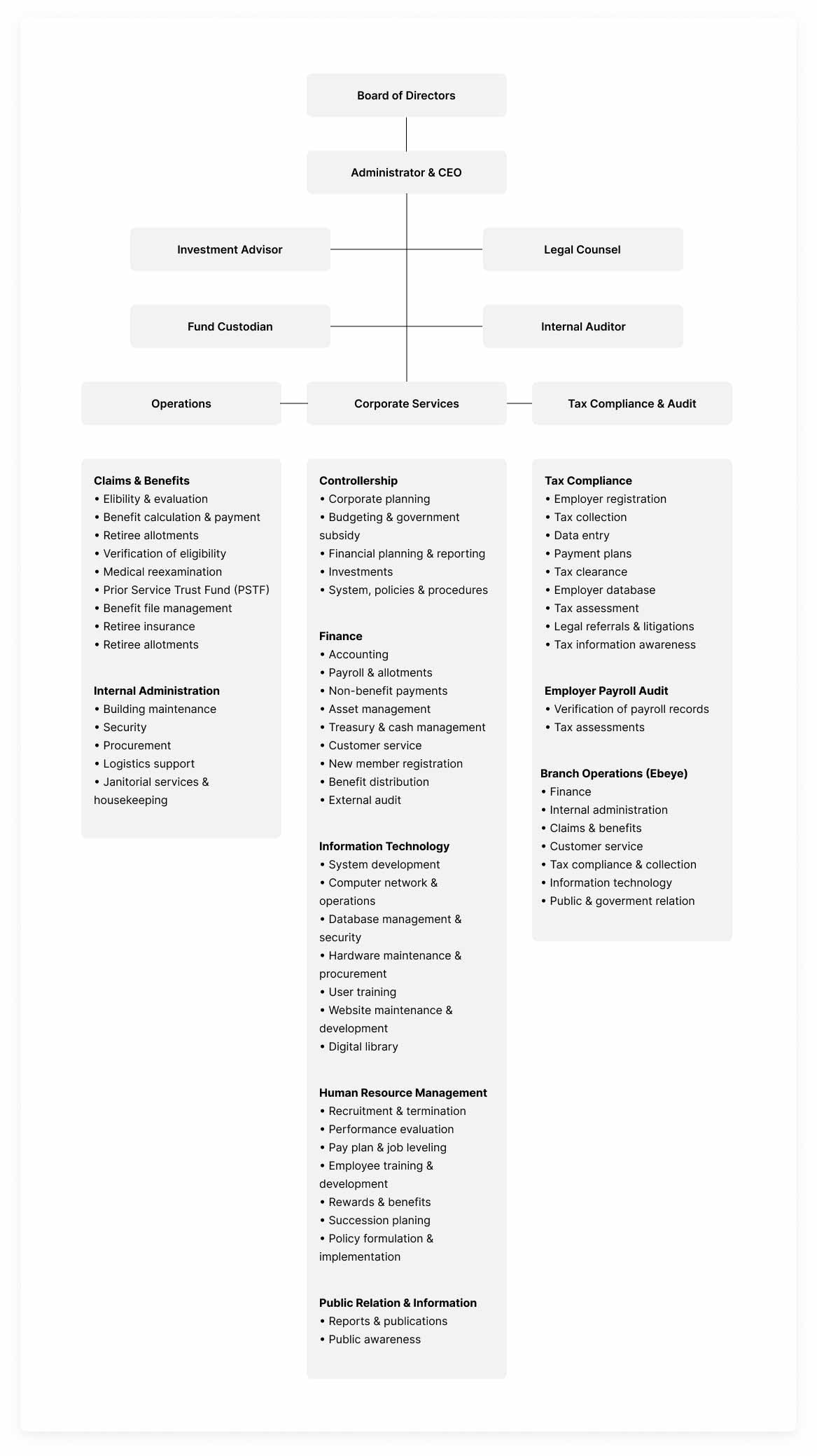

OUR ORGANIZATION

Have A Closer Look At Our Organizational Structure